Home

Salary Vs Hourly Calculator . That is the compensation the worker will receive at the end of the month. If you work a 2,000 hour work year then divide your annual earnings by 2,000 to figure out your hourly wage.

Converting Employees From Hourly To Salary from www.patriotsoftware.com This calculator is based on 2021 ontario taxes. Hourly wage paycheckcalculator need to calculate paychecks for your 1099 workers? So if you make $60,000 a year that would first become $60 & then divide that by 2 to get $30 per hour. A contract for an hourly worker, however, can add additional protections, such as providing vacation pay, sick leave, and special holiday pay. Eligibility for more, better benefits 4.

So if you make $60,000 a year that would first become $60 & then divide that by 2 to get $30 per hour. If you make $75,000 a year, your hourly wage is $75,000/2080, or $36.06. Convert my salary to an equivalent hourly wage. So if you make $60,000 a year that would first become $60 & then divide that by 2 to get $30 per hour. The calculator below will help you compare the most relevant parts of w2 vs 1099 by looking at how the two options affect your income and tax situation, but it's important to note that this is not an exact calculation of your taxes because many other factors outside the scope of this comparison can affect your tax situation. Generally speaking, a salary is predetermined. $14/hour * 120 hours= $1680.

Source: www.thecalculatorsite.com This calculator is intended for use by u.s. The following is the salary conversion table that shows the hourly, weekly, monthly and annual salaries for hourly rates ranging from $1 to $100. Yearly salary $ hours per week.

There is in depth information on how to estimate salary earnings per each period below the form. If you make $75,000 a year, your hourly wage is $75,000/2080, or $36.06. Yearly salary $ hours per week.

If you work a 2,000 hour work year then divide your annual earnings by 2,000 to figure out your hourly wage. A contract for an hourly worker, however, can add additional protections, such as providing vacation pay, sick leave, and special holiday pay. Some autonomy over your schedule.

Source: www.researchgate.net Hourly rates, weekly pay and bonuses are also catered for. Math behind the salary calculator in case you want to convert hourly to annual income on your own, you can use the math that makes the calculator work. $14/hour * 120 hours= $1680.

How to calculate pay for salary vs. The formula for salary to hourly we use is: Hourly rates, weekly pay and bonuses are also catered for.

Advantages and disadvantages as with anything, there are pros and cons of working on a salary and an hourly rate. Time and a half) 3. At $75,000, you hourly wage is $75,000/1,950, or $38.46.

Source: blog.mint.com So, the salary looks like this: So isn't roger the consultant also really costing us more than his hourly rate? Don't forget that transitioning an employee from hourly to salaried or vice versa does not change their eligibility for overtime.

How much do you get paid:*. So isn't roger the consultant also really costing us more than his hourly rate? If you work a 2,000 hour work year then divide your annual earnings by 2,000 to figure out your hourly wage.

Ability to dedicate time to other interests 4. There is in depth information on how to estimate salary earnings per each period below the form. Do you know your annual salary and want to know what that equates to as an hourly rate?

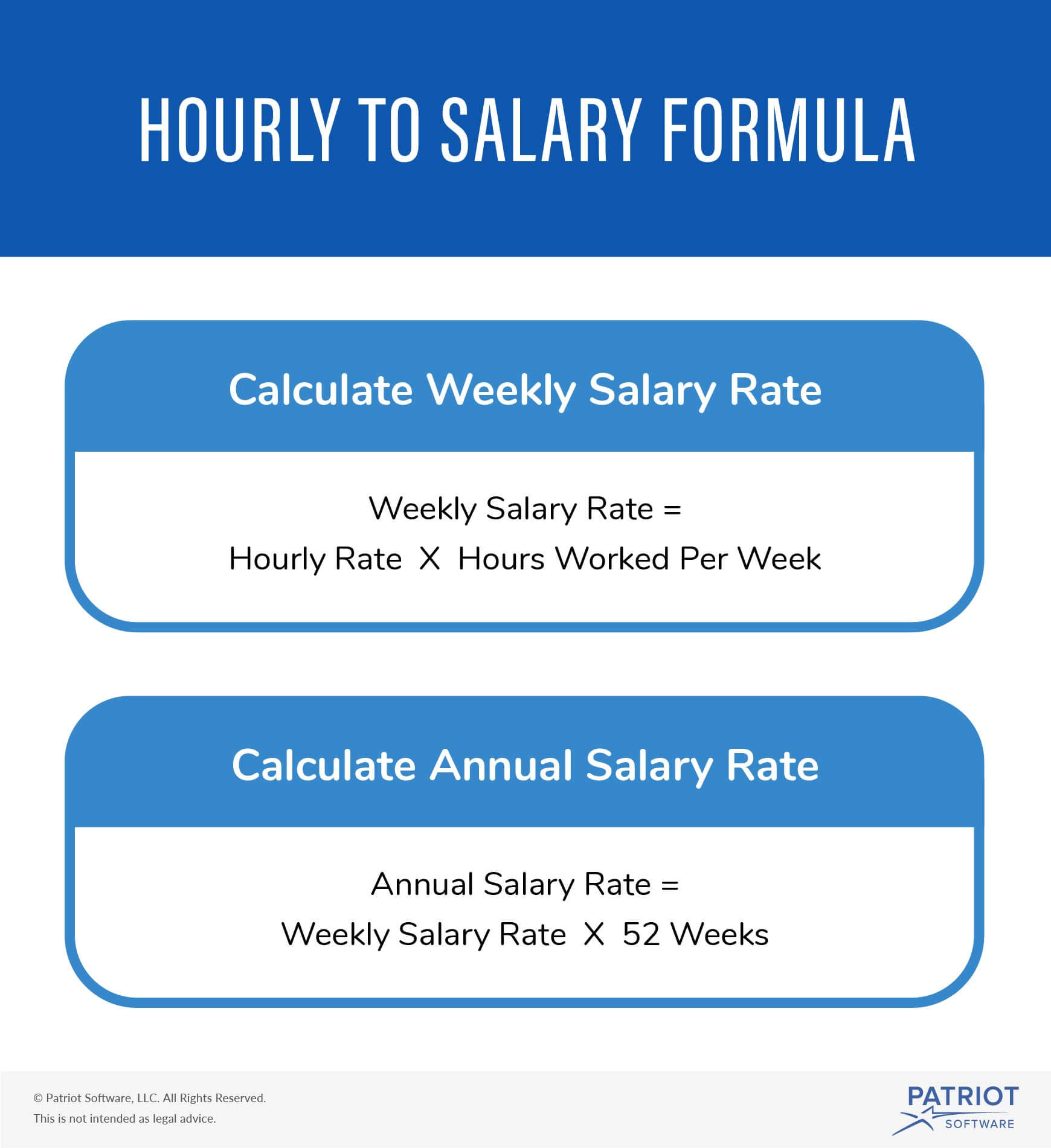

Source: ec.europa.eu The salary converter will help you do the comparisons simply and efficiently. So isn't roger the consultant also really costing us more than his hourly rate? Then, multiply that number by the total number of weeks in a year (52).

Employees earning less than $23,660 per year must be eligible for overtime pay. So, the salary looks like this: Take your hourly rate and multiply it by 2,080, which is the number of hours in a year if you work 40 hours a week for 52 weeks.

Fill the weeks and hours sections as desired to get your personnal net income. If you work 37.5 hours a week, divide your annual salary by 1,950 (37.5 x 52). Also you may want to see if you have one of the 50 best jobs in america.

Source: ec.europa.eu You may also want to convert an hourly wage to a salary. Trying to compare jobs where everyone quotes different amounts on a weekly, hourly, annual basis or just need a quick way of finding out overtime rates? This calculator is based on 2021 ontario taxes.

The real cost of consultants. This calculator can be helpful if you want to compare your present wage to a wage being offered by a prospective employer where each wage is stated in a different periodic term. At $75,000, you hourly wage is $75,000/1,950, or $38.46.

Hourly daily weekly monthly annually. If you make $75,000 a year, your hourly wage is $75,000/2080, or $36.06. Don't forget that transitioning an employee from hourly to salaried or vice versa does not change their eligibility for overtime.

Source: www.marketing91.com Then, multiply that number by the total number of weeks in a year (52). A contract for an hourly worker, however, can add additional protections, such as providing vacation pay, sick leave, and special holiday pay. Paid time off and sick days 3.

To determine your hourly wage, divide your annual salary by 2,080. $14/hour * 120 hours= $1680. The formula for salary to hourly we use is:

If you work a 2,000 hour work year then divide your annual earnings by 2,000 to figure out your hourly wage. Gross annual income = (# of hours worked per week) x (# of weeks worked per year) x (hourly wage) The following is the salary conversion table that shows the hourly, weekly, monthly and annual salaries for hourly rates ranging from $1 to $100.

Thank you for reading about Salary Vs Hourly Calculator , I hope this article is useful. For more useful information visit https://labaulecouverture.com/